HPR (Recession) = ((4-93)+2)/93 = -93.55%Įxpected Return=(Probability of Boom * Return from Boom) + (Probability of Normal * Return from Normal) + (Probability of Recession * Return from Recession)

(c) Calculate the standard deviation of the portfolio if half of the investment is done in Company A and the rest half in Company BĬalculations of Holding Period Return (HPR) (b) Calculate the standard deviation of Company B (a) Calculate the standard deviation of Company A The common stock of Company B sells for $ 93 per share and the same offers following payoffs for the next year:

The common stock of Company A sells for $ 28 per share and the same offers following payoffs for the next year Standard deviation in the case of two companies in the portfolio

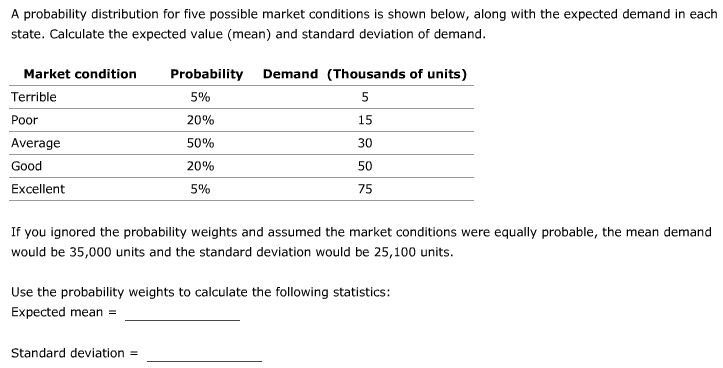

Standard Deviation will be Square Root of Variance Expected Return = (Probability of Boom * Return from Boom) + (Probability of Good * Return from Good) + (Probability of Normal * Return from Normal) + (Probability of Recession * Return from Recession)

0 kommentar(er)

0 kommentar(er)